Marginal Tax Rates 2025 Alberta - Winter 2021 Canadian Tax Highlights Cardinal Point Wealth, Learn about marginal tax rates and how they differ from the average tax. This quick guide is your gateway to understanding the ins and outs of alberta’s tax brackets and rates. Previous year income tax rates. Welcome to our comprehensive guide to understanding the effective tax rate and marginal tax rate on a $ 70,000.00 annual taxable income in alberta based on the 2025 tax tables.

Winter 2021 Canadian Tax Highlights Cardinal Point Wealth, Learn about marginal tax rates and how they differ from the average tax. This quick guide is your gateway to understanding the ins and outs of alberta’s tax brackets and rates.

Alberta Tax Rates and Tax Brackets in 2025, How much tax will i pay on my income in alberta? Calculate your annual federal and provincial combined tax rate with our easy online tool.

, It’s here to help you make sense of your finances and plan with confidence. Calculate your annual federal and provincial combined tax rate with our easy online tool.

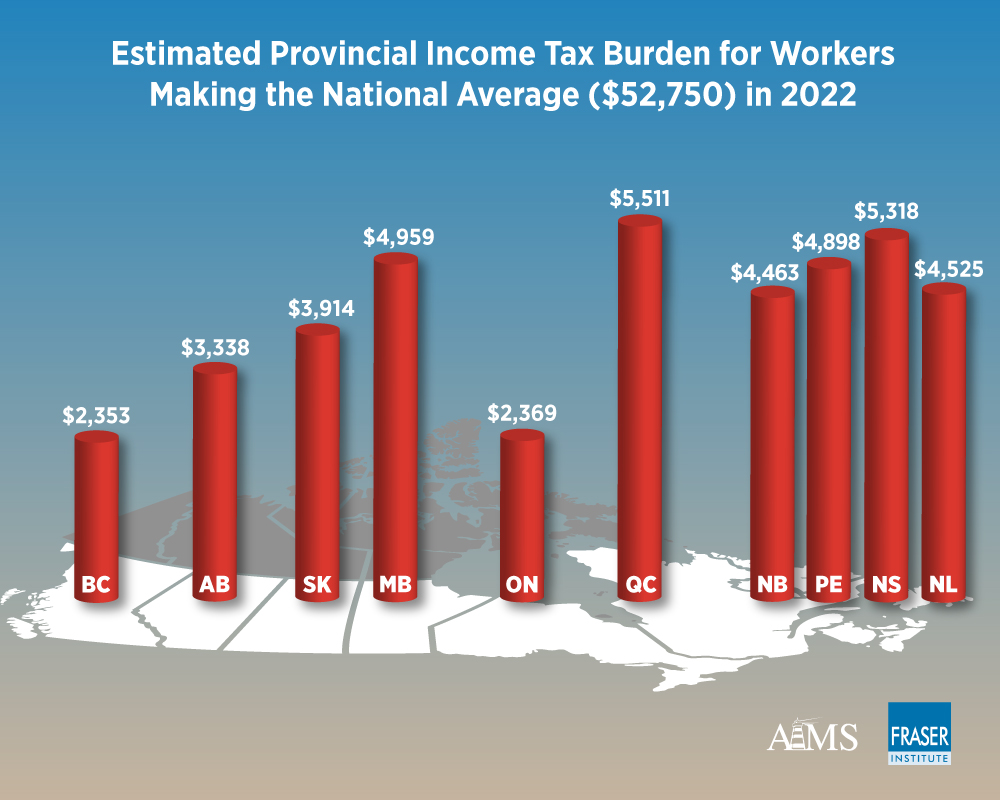

Choose your province or territory below to see the combined federal & provincial/territorial marginal tax rates for each tax bracket.

2025 Tax Rate Single Marginal Teddi, For example, if your taxable income after deductions and exemptions was $45,000, you owe 15% of that for your federal tax, and the alberta provincial amount you owe. If you make $60,000 a year living in.

Marginal Tax Rates 2025 Alberta. Alberta salary calculator , (ab tax calculator) estimate of your 2025 taxes using our online tax calculator. Alberta income tax calculator 2025.

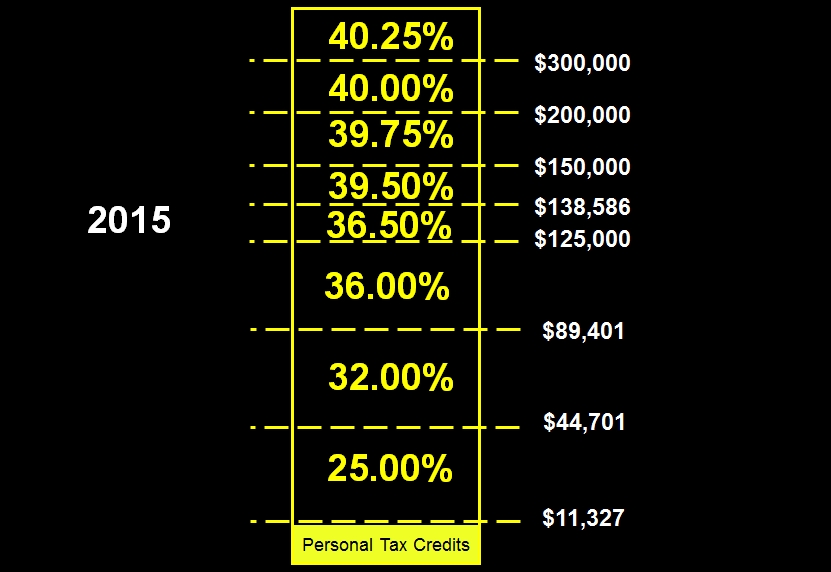

In the realm of taxation, these two concepts play a crucial role in determining your tax obligations and guiding your financial planning strategies.

Select the province that you live in to determine your average and marginal tax rates.

Ab budget 2025 introduces a new personal tax bracket for income up to $60,000 starting in 2026.

Business & Tax Insights Archives Page 10 of 22 Kalfa Law Firm Firm, Previous year income tax rates. Forbes advisor canada has a tool to help you figure it out.

Tax Rates 2025 Canada Image to u, Welcome to our comprehensive guide to understanding the effective tax rate and marginal tax rate on a $ 70,000.00 annual taxable income in alberta based on the 2025 tax tables. The bpa is the amount of income an individual can earn without paying any tax.

Marginal Tax Brackets For Tax Year 2025 Eve Harriott, The bpa is the amount of income an individual can earn without paying any tax. These rates apply to your taxable income.

Marginal Tax Rates 2025 Alberta Drucy Zitella, However, this timeline is contingent on whether alberta can maintain a balanced budget while providing this tax cut. The ab tax brackets in 2025 is 4.2%, compared to 6.0% in 2025.

New tax rates in Alberta, Marginal tax rate for capital gains is a % of total capital gains (not taxable capital gains). Previous year income tax rates.

Canada Tax Rates 2025 Lyndy Roobbie, The bpa is the amount of income an individual can earn without paying any tax. Alberta 2025 and 2025 tax rates & tax brackets.